how are property taxes calculated in lee county florida

However left to the county are appraising property mailing levies collecting the tax engaging in compliance measures and. Property Sales Information Courts Foreclosure Tax Deed Sales.

Lee establishes tax rates all within the states statutory rules.

. Our property tax data is based on a 5-year study of median property tax rates conducted from 2006 through 2010. Discounts are available for early payment. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Apply for Business Tax account Edit Business Tax account Run a Business Tax report Run a Real Estate.

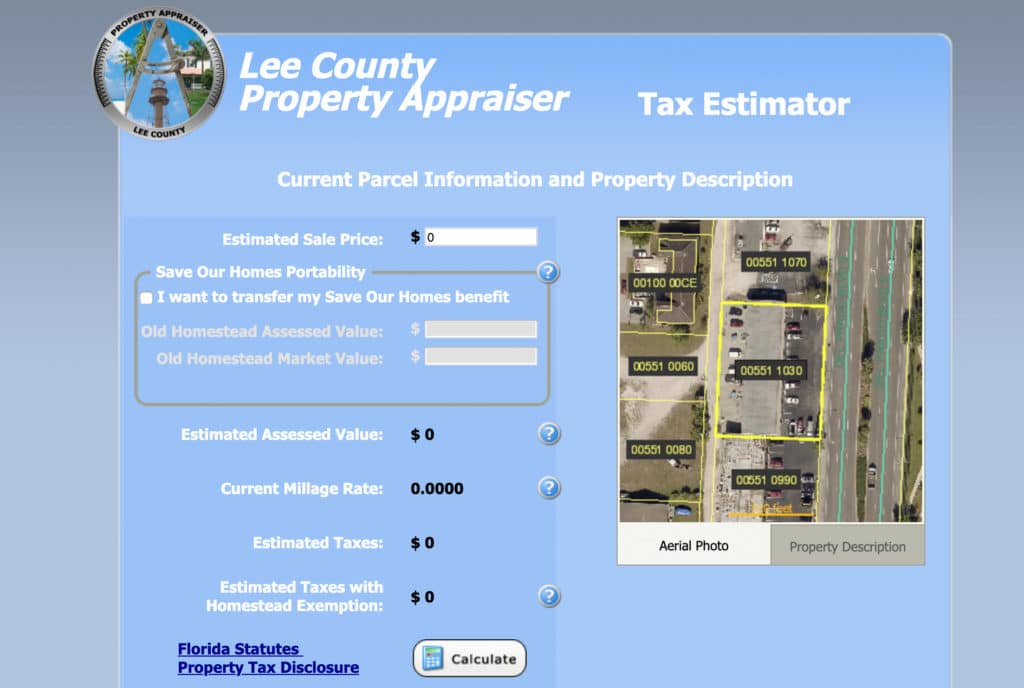

For more information on making. When it comes to real estate property taxes are almost always based on the value. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Tax bills are mailed by November 1 and payment is due on or before March 31 of the following calendar year. Find the assessed value of the property being taxed. Ad valorem taxes are based on the value of.

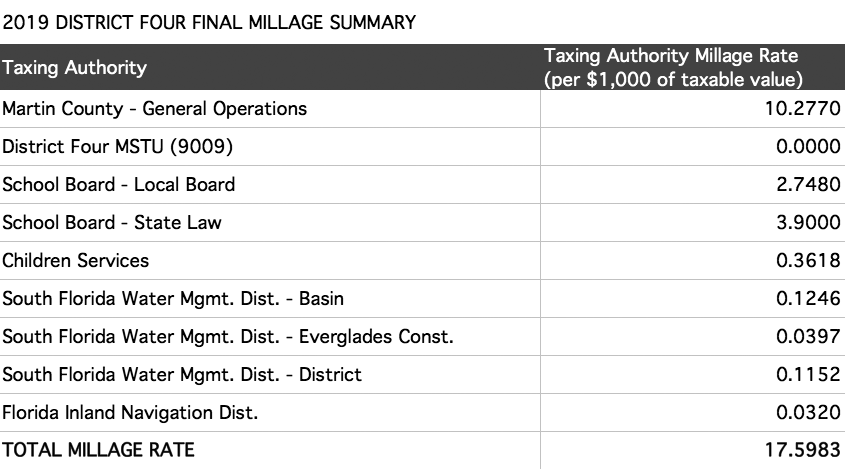

Property Fraud Alert Service. They range from the county to city school. Historically tax rates have fluctuated within a fairly.

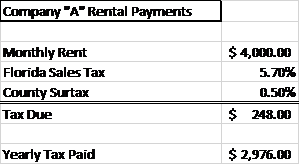

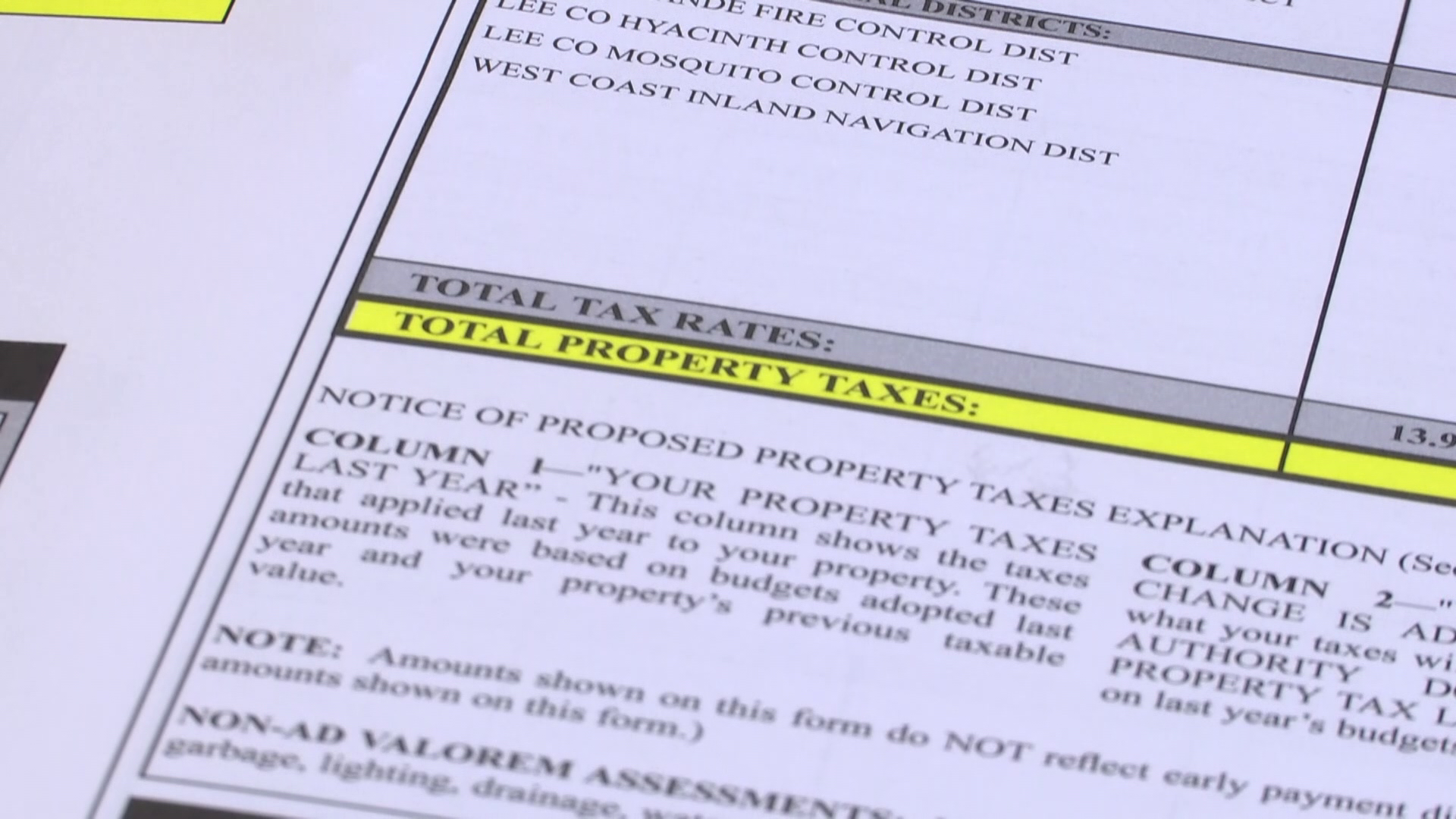

Real estate property taxes also referred to as real property taxes are a combination of ad valorem and non-ad valorem assessments. That amount is multiplied by the established tax levy which is the total of all applicable governmental taxing-empowered units levies. The actual tax rate used to calculate property taxes is set every year by the various taxing authorities in Lee County.

Census Bureau American Community Survey 2006. For comparison the median home value in Lee County is. Unrecorded Plats and Maps Official Records Lists of Unrecorded plats and maps.

To calculate the property tax use the following steps. If you have already applied for Homestead Exemption but not portability be sure to complete the application and return it to the Lee County Property. The remaining 20000 of your propertys value is taxable because its less than the 50000 minimum to be eligible for the additional homestead exemption.

Homeowners In Lee County Hit With Increased Property Tax Bills

Lee County Fl Real Estate Tax Estimator

Florida Property Taxes Explained

Broward County Fl Property Tax Search And Records Propertyshark

10 Highest And Lowest Florida County Property Taxes Florida For Boomers

Martin County Property Appraiser 2019 Millage Codes Tax Rates

About Our Office Lee County Property Appraiser

Lee County Property Appraiser S Office Fort Myers Fl

With Save Our Homes Homeowners Savings Are Governments Loss

Lee County Property Appraiser How To Check Your Property S Value

Lee County Tax Collector Mississippi

Lee County Tax Assessor S Office

Region S Property Tax Dollars Go Far For Some Counties Business Observer Business Observer

Tax Estimator Lee County Property Appraiser

Homeowners In Lee County Hit With Increased Property Tax Bills

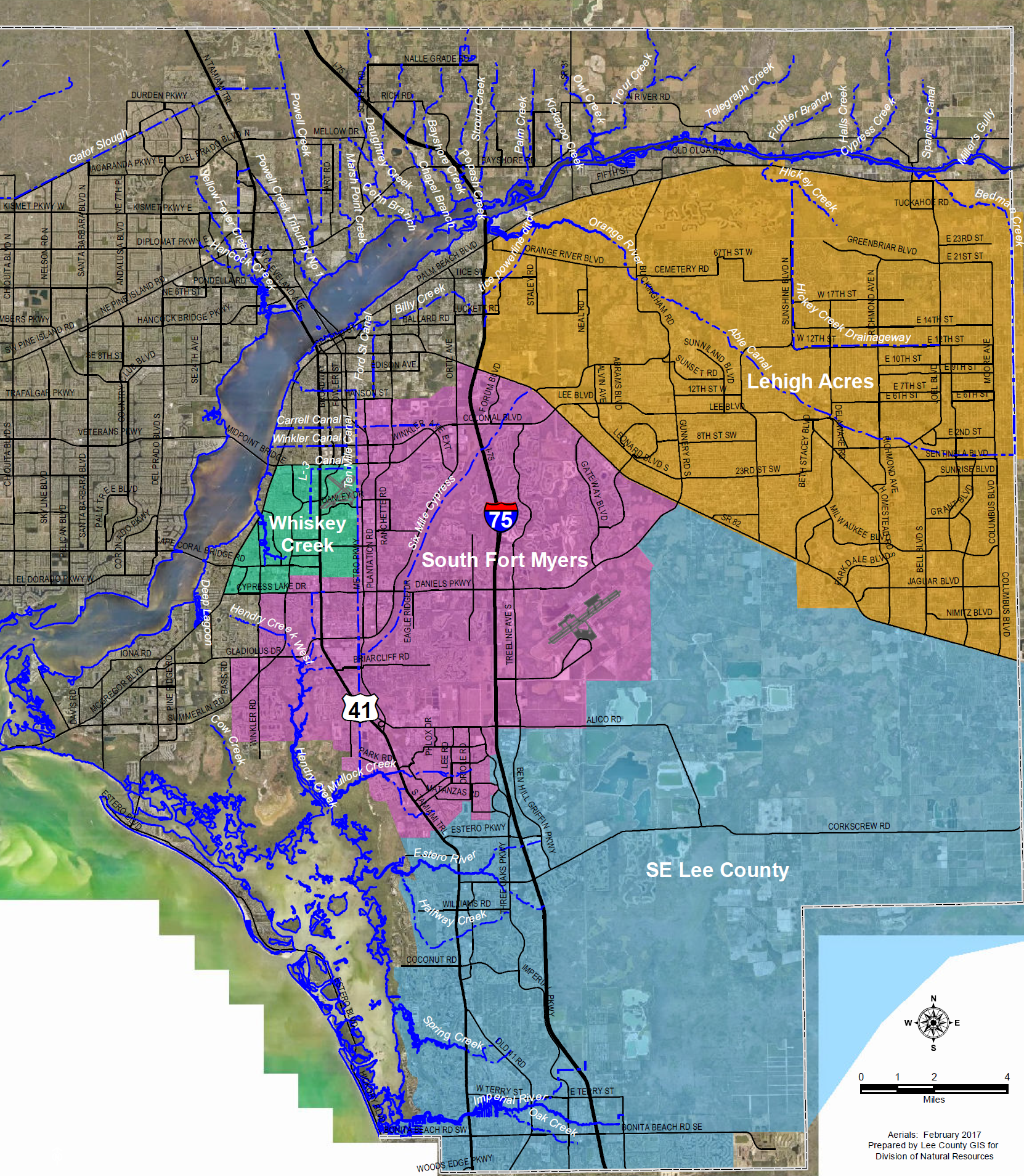

Lee County Fl Property Search Interactive Gis Map

Lee County 2020 Estimated Taxable Values Are Back To High From 2007 Firstpointe Advisors Llc